Investment Link Insurance

Investment link insurance could effectively assist clients to achieve financial targets because:

The term period of such plan usually ranges from 10 to 30 years, as such it can capture the investment opportunities in every economic cycle. Long term investment could also benefit the clients through compound interest effect, and help achieve long term investment goals.

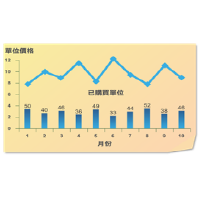

Regular Saving Investment Link Insurance Plan utilizes dollar cost averaging to invest regular amount periodically. By purchasing more fund unit when the fund price is lower, client could lower the general investment cost.

Investment link insurance is agile with flexibility, fund choice is also changeable at any time, so client could base on different market situation and risk appetite to switch to a more suitable fund for better return; client could also increase/decrease/stop/withdraw part of the contribution before the plan is mature.